To hold or not to hold? That’s the question being asked by share-holders of Union Jack Oil (LON: UJO) & Reabold Resources (LON: RBD).

To hold or not to hold? That’s the question being asked by share-holders of Union Jack Oil (LON: UJO) & Reabold Resources (LON: RBD).

There’s been a lot of piss & wind posted recently on the, Rathlin operated, West Newton major oil & gas discovery. The key to investing and even trading is to pick your entry and your exit, based on what you know as opposed to what’s being eternally spouted on social media. There’s one twitter lunatic who seems to think (Wrongly) that UJOs’ head honcho is responsible for putting in the HSE, O&G paperwork as well as ordering all the capital equipment for the imminent drill/s and any delay is their fault.

Oil & gas drilling by its very nature is bureaucratic. It’s the Operator Rathlin who lodge ALL West Newton applications. Partners have a non operated interest. If you have any doubts on your trade/investment in any company or in any sector then sell up and move on. It’s as easy as that. Get out, there’s no shame in selling.

Yesterdays Rathlin update was forced due to the amount of erroneous speculation circulating on social media.

“Rathlin Energy (UK) Limited, as operator of the West Newton A-2 well, is providing the following update regarding the Extended Well Test.

Preparations for the retesting of the well are progressing both from an operational and a regulatory standpoint.

Coordinating the availability and timing of services, equipment, personnel and other aspects of operations with the requirements of our regulators is imperative.

These activities and approvals are often dependent upon one another.

Rathlin Energy (UK) Limited will provide operational updates via this website when appropriate.

Kind regards

THE RATHLIN ENERGY (UK) LIMITED TEAM”

So with the above in mind, here’s exactly what’s going on. The Extended Well Test and site mobilisation are a matter of days away. All equipment has been sourced with a date pencilled in for the EWT, and the drilling by Rathlin of West Newton 2B could happen in concert or be very close behind the EWT. One rubber stamp is awaited from the EA. That application, according to my sources, went in last week. The usual turnaround from the HSE/EA is 14 days. So my ‘back of the fag packet calculations‘ are end of this week beginning of next. Site mobilisation and EWT are imminent. Don’t be fooled or get caught out. When the news drops the SPs are only going one way.

Reabold and Union Jack are fully funded for at least 18months, both have paid up in advance. There should be no placings in 2020. Especially UJO whose asset/production base are all UK onshore. Onshore drilling, compared to offshore, is way, way less expensive.

There are at least 2 oil predators awaiting the EWT oil flow results. That means that if it flows, as expected, from the 60,000,000+ boe then there’s a real possibility, depending upon how far West Newton 2B has progressed, that the asset will be bought out by either one or both Majors in partnership, circling.

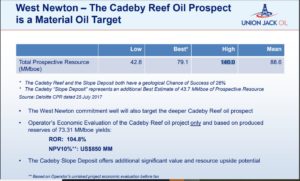

Share-holders of both listed companies need to remember that West Newton is a billion dollar oil play:

A major UK onshore Oil & Gas discovery has already been called by the companies. It’s of National importance and as such oil minnows or their interests get swallowed up. That’s how it works in the oil sector.

Any investor thinking that Rathlin will remain the operator of a Major UK O&G discovery are in ‘la’ la’ land’. An offer or offers will come. That’s a given. Of course oil has to flow. There are only 2 companies i’m invested in: Reabold & UJO. That’s because both have exposure to West Newton. I’m not looking at any of their other assets regardless of how good they maybe. It’s all about West Newton for me. All the companies involved are convinced that (barring a major onsite explosion or a military takeover of the UK) oil will flow. It doesn’t get any better than that…..

Viva

Dan