- Matra’s Peter Hind?

It’s been yet another tough week for private Investors as the on-going sovereign debt crisis lurches on and on with no sign of an end. So with-out Further ado here’s the weekly Oil & Gas round-up.

Afren;

Released their Interim Management Statement, for the period 1 July 2011 to 15 November 2011. Highlights included thus; Group net production currently circa 28,000boepd;expecting circa 50,000 boepd 2011 exit rate…trong financial position – US$223 million cash at bank; net debt US$519 million (gearing 45%)…Acquisition of OML 26 (Nigeria) – following government and other customary approvals, formal completion expected shortly…Ebok (Nigeria) – Phase 1 production currently at 15,800 bopd, steadily being increased towards upper end of targeted 17,000 bopd; four out of five wells available for production at Ebok Phase 2, with well test rates of 5,000 bopd, supporting developed capacity of 20,000 bopd; three additional D1 producers expected onstream by end 2011…Okoro (Nigeria) – production stable at 18,000 bopd following debottlenecking work…Barda Rash (Kurdistan) – Field Development Plan submission expected end 2011; phased development with production start-up mid 2012. Initial phases to target 506 mmbbls recoverable light oil. Osman Shahenshah, Chief Executive of Afren plc, said: “We are pleased to report that production at Ebok Phase 1 is responding in line with prognosis to water injection and is being steadily increased to the expected 17,000 bopd level. Elsewhere at Ebok, we have a number of additional production wells that will be brought onstream by year end, which combined with existing production at Okoro and in Côte d’Ivoire keeps us on track to enter 2012 with net production of circa 50,000 boepd attributable to the Company. The Company remains in a strong position financially, with significant cash resources available and a profitable and growing production base underpinning an internally funded forward work programme.”

Aminex;

Released their Interim Management Statement copys of which can be viewed by clicking this link. http://www.aminex-plc.com/

Aurelian Oil & Gas;

The Horodnic-1 appraisal well has reached TD of 1,660 metres MD (-983 metres TVDSS). The well was targeting a sand-prone interval within the Sarmatian-Badenian section which had been encountered in the Voitinel-1 well, approximately 2.5 kilometres to the northwest. Within the primary objective section, a gross interval of approximately 40 metres of interbedded sands and shales was encountered. However, elevated gas readings were restricted to the topmost section indicating that the interval is likely to be un-commercial. Wireline logging has been completed and the well is currently being plugged and abandoned.

Cadogan Petroleum;

Announced their Interims today hidden in the statement the company revealed it had begun legal action to recover the GPS DEBT “As previously advised payments due from GPS in 2011, totalling $30 million, have not yet been received. Although discussions continue with GPS on rescheduling the payment under the settlement agreement put in place in October 2009, the Group has commenced legal action to recover the debt. The legal title to the gas plants remains with Cadogan” As one legal door opens another one closes. The litigation, which commenced in June 2009, against the former Chief Executive Officer, Chief Operating Officer and certain third parties including individuals and suppliers has now been substantially concluded. Cadogan’s cash balance at the date of this announcement is £43.5 million ($68.5 million). Monthly revenue from all active fields is now running at £0.3 million per month net to Cadogan.

Caza Oil & Gas;

Released third quarter results with an operational update. Copys of which can be viewed by clicking the link! http://www.cazapetro.com/index.php?id=335

Chariot Oil & Gas;

The Africa focused exploration company, has kicked off a 3D seismic acquisition programme in its Central Blocks, offshore Namibia. The 90-day programme is being carried out in conjunction with Chariot’s farm-in partner Petroleum Geo-Services (PGS) and will cover 3,500 sq km using the latest Geostreamer technology.

Egdon Resources;

Told Investors that it had reached agreement to farm-out an interest in Nottinghamshire licence PEDL206 to Angus Energy Kelham Hills Limited. Under the terms of the agreement, Angus will acquire a 50 per cent interest in the licence from Egdon in return for carrying the Company for 15 per cent of the costs of two well’s or 25 per cent of the cost of a single well. The wells or well are to be drilled during the initial term of the licence, which ends on 30 June 2014. As part of the agreement Angus will also assume operatorship of the licence. Following completion, Egdon will retain a 25% interest in the licence.

Enegi Oil;

At last some good news came from Enegi as the company announced details of the next stage of theier workover programme has been finalised. One of the final elements was the appointment of a service provider with the appropriate experience and expertise to implement the proposed programme. The Company is pleased to announce that Schlumberger has been appointed to undertake the programme. The work programme was formally submitted to the Newfoundland and Labrador Department of Natural Resources on 10th November 2011 for approval. The programme submitted to the DNR which targets the Upper Aguathuna, describes the activities that will be undertaken during the workover as well as the testing activities that will take place to maximise the quality of data obtained. Enegi anticipates that the programme will be approved in the coming days, following which Schlumberger will mobilise the required equipment and personnel to site. Accordingly, site preparation and acquisition of materials has already commenced. Further announcements will follow as the programme is implemented. Alan Minty, CEO, commented: “The delays have been frustrating, but necessary in order to ensure that the most appropriate work programme has been devised. We are delighted to have secured a provider of the calibre and expertise of Schlumberger to the project and believe that we now have all the necessary building blocks in place to successfully carry out the next stage of the workover, whose objective is to move to sustainable production.”

Europa Oil & Gas;

Bad day at the office for Europa. The Horodnic-1 exploration well in the Brodina Exploration Area in northern Romania was P+A.

Horodnic-1 reached a total depth of 1660 MD in Badenian Infra-Anhydrite sandstone. no potentially commercial hydrocarbon bearing interval was found. The well will be plugged and abandoned.

Leni Gas & Oil;

Said it plans to acquire an additional 1,000 km sq of 3D seismic in Area 4, offshore Malta. Mediterranean Oil and Gas as operator of the Area 4 PSC has contracted Fugro-Geoteam Pty Ltd to acquire the additional data using the vessel R/V Geo Barents which is presently mobilising to the location and is expected to commence acquisition around the 16 November 2011. LGO owns a 10% interest in the PSC covering Blocks 4, 5, 6 and 7 offshore Malta adjacent to the internationally recognised border with Libya. The PSC was recently extended until 2013 and the additional seismic data was agreed in order to fully define a drilling prospect. Processing of the 3D will commence immediately after acquisition, which is anticipated to take about 30 days to complete, and will be available for interpretation in late 1st quarter 2012.

Matra Petroleum;

The independent oil and gas exploration and production Company with operations in Russia that owns 100% of the Sokolovskoe oil field discovery, announced a placing with Delek Energy Systems Ltd of 70,000,000 new ordinary shares at 0.5p per share to raise £350,000. This together with the 170,000,000 placed recently, also at 0.5p per share, through Fox Davis Capital Ltd., raises a total of £1.2 million. The funds raised under the Placing will be used for working capital and to initiate production from Well A-13, the Sokolovskoe Field. Lets hope the pump isn’t a water pump!

The oil and gas exploration and production company focused on Kazakhstan, announced a healthy set of interim results for the six months ended 30 September 2011. Much to in-depth to be posted on the round-up so any one wishing to view and extrapolate can do so by? Yes you’ve guessed it click the link! http://www.maxpetroleum.com/uploads/11-11-14-rns-interimresults.pdf

Mediterranean Oil & Gas;

Malta Operations Update. See Leni Oil & Gas.

Nautical Petroleum;

Informed the market that the Tudor Rose appraisal well 14/30a-5 in Central North Sea Block 14/30a was spudded at 14:22 hours on 16 November 2011. The well is being drilled approximately 2.5km NNW of the 14/30a-2 discovery well. The main objectives of the appraisal well are to obtain a core of the Beauly sandstone reservoir and to collect reservoir fluid samples to establish the API and viscosity of the oil. The well is being drilled using the Sedco 704 semi-submersible rig and is being managed by Applied Drilling Technology International . The well is expected to take approximately 20 days, subject to weather and operational requirements.

Nighthawk Energy;

Updated on Jolly Ranch with a Q3 2011 Production Update. Its quarterly production update, covering the quarter ended 30 September 2011. Q3 production of 2,592 barrels net to Nighthawk (net of tax and royalty) (Q2: 3,079 barrels net to Nighthawk) Q3 production is below the level of Q2 due to a mechanical breakdown of the Craig 4-4, the longest producing well at Jolly Ranch. Once this well is placed back on pump, production levels are expected to rise.

Range Resources;

Good news came today from Range as the company announced an Increase in Proved (P1) Reserves in Trinidad by 490% from 2.6 Mmbbls to 15.4 Mmbbls. The 12.8 Mmbbls increase in Proved (P1) Reserves has independent valuation. (PV10) of approximately US$ 290MM. Proposed production program (from new reserves) of 1m-1.5m bbls per year for a minimum of 8 years. Trading was brisk as the sp rallied on the news only to fall back after it was realised by private Investors that the Georgia drill had been suspended! Range also updated via an operational update copys of which can be viewed by clicking the link.http://www.londonstockexchange.com/exchange/news/market-news/market-news-detail.html?announcementId=11038279 Red Emperor Resources; advised that operations are currently suspended on the Mukhiani well with the rig on standby with a skeleton crew as the Company awaits final technical analysis on the well. The Company will provide an update as to the results as soon as they are finalised, which is expected shortly. Upon a decision to move, it is expected the second well in the Georgian exploration program will spud within a 4-6 week period.

Salamander Energy;

Announced a disappointing the result on the recent appraisal drilling and testing programme on the South Sebuku-2 (“SS-2”) well, Bengara-1 PSC, East Kalimantan. The Group has a 42% non-operated interest in the Bengara-1 PSC. The SS-2 well was drilled to a total depth of 1,386 MDSS and encountered over 15 metres of net gas-bearing sandstones in the Tabul formation. Drill stem tests were conducted across three of the gas bearing zones and flowed at an aggregate rate of 10.9 MMscfd. These results, together with the DST data from the South Sebuku-1 discovery well demonstrate the commerciality of the South Sebuku accumulation. The South Sebuku-2 well has been suspended as a potential future producer.

San Leon;

Announced the successful completion of its first shale gas exploration well in the Baltic Basin. The Talisman Energy operated Lewino 1G-2 well, on the Gdansk W Concession in Poland, has been drilled to 3,600 meters. During drilling continuous gas shows were encountered over more than 1,000 meters in the middle and lower Silurian shales, Ordovician, and upper Cambrian. Gas shows consist of methane (C1) with a small percentage of ethane, propane, butane, and pentane (C2-C5+). Over 310 meters of core were taken in the well to evaluate the rock properties and an extensive open hole logging program was also performed to further evaluate the potential of the area. Evaluation and interpretation of the core and logs is expected to take 3-4 months in preparation for continued operations later in 2012. Following completion of the well for potential future operations Talisman will move the rig to the Braniewo Concession to start drilling the Rogity-1 well, which will be immediately followed by a well in the Szczawno concession. Future operations are expected to include a long offset horizontal and multistage frac. The company will release further information pending technical results and evaluation.

Sound Oil;

Said that the Casa Tiberi-1 exploration well in Italy, which is operated by the Company’s wholly-owned subsidiary Apennine Energy srl, has been successfully drilled to a total depth of 715 m measured depth. Logging of the well has established a gross hydrocarbon column of 14.9 m, comprising several high quality gas bearing reservoir sands. Sound Oil is suspending the well as a gas discovery pending future work in the coming months, to determine the extent and commerciality of the accumulation.

Valiant Petroleum;

The 7121/9-1 well failed to encounter reservoir sands in either of the target Lower Cretaceous or Upper Jurassic horizons. The well will now be drilled to total depth following which the well will be logged before being plugged and abandoned.

Xcite Energy;

Stated that “Financing discussions continue to progress satisfactorily and the Company’s objective is to conclude these in a consistent timeframe with approval by DECC of a Field Development Plan for the Bentley field and the rig deployment”. The Company’s unaudited Financial Results for the three months ended 30 September 2011 can be found at the following link:http://www.rns-pdf.londonstockexchange.com/rns/0739S_-2011-11-14.pdf

hi dan like this email really good round up

thanks

marcus

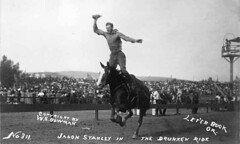

matra picture lol

Great work Dan…. But there is no comments on Sefton even after a mail from Dr. Micheal Green to you…. :-s

Even you’re taking silence as weapon like the SER board? 🙂

Thanks,

Siv A’dan

Hi dan,

If I wrote an article on Aminex Plc, would you post it? I’d make it detailed, but concise.

Cheers

P2 up 70%

4 rigs on the go

Almost at break even – not selling export yet so this will rise

No chance we won’t get FFD

SW could be 92m and 10,000 bopd alone

8 wells online in next 6 weeks

Production of 4500 bopd per day by year end

6 more drills in next 6 weeks

EMBA rated at 1/3 chance of success

Shallows for 2012 identified , expect better success rate than 2011

In other news des up 20% on no news with zero oil revenue or production

Max down 2% after releasing the above

Excellent site Dan. Love the weekly round-up.

Keep up the great Blogging. Cant wait to see the new site which I will be joining.

Cheers Mate.

Harryo